Navigating the New 34% Reciprocal Tariffs: What to Do with Your In-Transit Goods

Recent updates from the U.S. government have introduced a new "reciprocal tariff" plan, which includes a 34% additional duty on all goods exported from China to the U.S. When combined with the previous two rounds of 10% tariffs, the cumulative duty rate now stands at 54%. This new policy raises critical questions about how these tariffs will be applied, when they will take effect, and what to do with goods already in transit. Let’s break it down.

Q1: What is the Scope of the New Tariffs, and How Much Will Be Added?

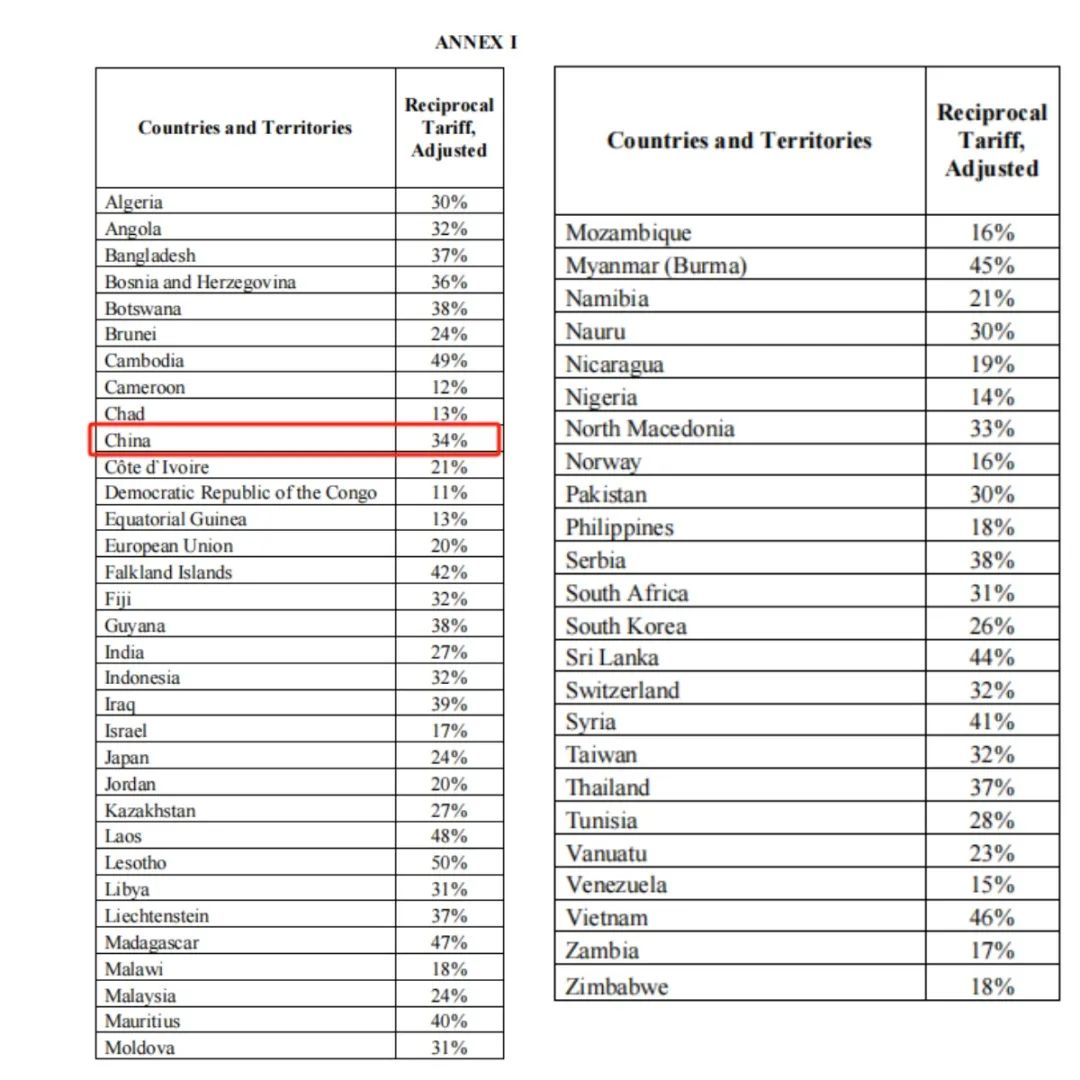

The newly announced "reciprocal tariff" plan imposes a 10% benchmark duty rate on goods from all countries, with exceptions for products covered under the United States Mexico Canada Agreement (USMCA). However, the U.S. will impose additional tariffs on countries with the largest trade surpluses against the U.S. China, in particular, will face an additional 34% ad valorem duty** on all goods exported to the U.S. (with exemptions for certain products).

Q2: When Will the New Tariffs Take Effect?

The new duty rates will apply to goods entering consumption or being withdrawn from a warehouse for consumption on or after

April 9, 2025, at 12:01 a.m. EDT. Goods that have already departed for the U.S. before April 9, 2025, will not be subject to the additional 34% duty.

Q3: How Are the Final Tariff Rates Calculated for U.S.-Bound Goods from China?

The new tariffs will significantly increase the overall duty rates on Chinese exports to the U.S. The calculation varies depending on the product category:

• General Products:

Tariff Rate = Base Rate + 301 Tariffs (if applicable, 7.5% or 25%) + 20% (previous two rounds of tariffs) + 34% (reciprocal tariffs)

• Steel and Aluminum Products:

Tariff Rate = Base Rate + 301 Tariffs (if applicable, 7.5% or 25%) + 20% (previous tariffs) + 25% (steel and aluminum surcharge)

• Motor Vehicles and Automotive Parts:

Tariff Rate = Base Rate + 301 Tariffs (if applicable, 7.5% or 25%) + 20% (previous tariffs) + 25% (automotive tariffs)

Q4: What Should Sellers Do with Their In-Transit Goods?

Sellers with goods already in transit are likely the most concerned about how these new tariffs will impact their shipments. Here are some actionable steps to consider:

1. Monitor Your Shipment Status

Keep a close eye on the estimated arrival date of your goods. If your shipment is expected to arrive in the U.S. before April 9, 2025, it will not be subject to the new 34% duty.

2. Communicate with Your Customers

If your goods are likely to be affected by the new tariffs, proactively reach out to your customers to discuss potential solutions, such as adjusting pricing or delivery timelines.

3. Consult a professional consultant

If you still have questions about tariff policies or cargo handling, Topway Shipping can answer them for you to ensure compliance and reduce risks.

4. Pay attention to tax bills

After the new policy takes effect, sellers need to pay attention to whether the goods are subject to an additional 34% tax, which is subject to the tax bill issued by the customs. If it is levied, the fees will be reimbursed on a real-time basis.

Adjust your strategy in a timely manner, monitor the status of your goods, maintain communication with your customers, and seek professional advice to address new trade challenges. I hope this article provides you with valuable insights and helps you seize opportunities in the complex world of trade!

Should you have any further questions, feel free to reach out to us anytime!

EN

EN

AR

AR

BG

BG

HR

HR

CS

CS

DA

DA

NL

NL

FI

FI

FR

FR

DE

DE

EL

EL

HI

HI

IT

IT

JA

JA

KO

KO

NO

NO

PL

PL

PT

PT

RO

RO

RU

RU

ES

ES

SV

SV

TL

TL

IW

IW

ID

ID

LT

LT

SK

SK

SL

SL

UK

UK

VI

VI

GL

GL

HU

HU

TH

TH

TR

TR

MS

MS

GA

GA

IS

IS

BN

BN

LO

LO

LA

LA